Accounting For Audit Fees

We went back and forth with our auditors regarding this point. They sent over this from the AICPA:

AICPA Technical Practice Aid 5290:

.05Accrual of Audit Fee

Inquiry—A CPA has been engaged to audit the financial statements of a client company. The audit is being conducted after year end. Is it proper to accrue the audit fee as an expense of the year under audit?

Reply—According to FASB Concepts Statement No. 6, Elements of Financial Statements, paragraph 145, “The goal of accrual accounting is to account in the periods in which they occur for the effects on an entity of transactions and other events and circumstances, to the extent that those financial effects are recognizable and measurable.” The audit fee expense was incurred in the period subsequent to year end. Therefore, it is properly recorded as an expense in the subsequent period. However, fees incurred in connection with planning the audit, together with preliminary procedures (for example, confirmation work) would be accruable for the year under audit.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

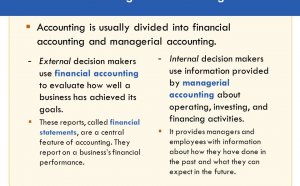

Financial and Managerial Accounting for MBA

Peter D. Easton Peter D. Easton is an expert in accounting and valuation and holds the Notre Dame Alumni Chair in Accountancy…

Read MoreFinancial & Managerial Accounting for Decision Makers

Target Audience Financial & Managerial Accounting for Decision Makers is intended for use in an introductory accounting…

Read More