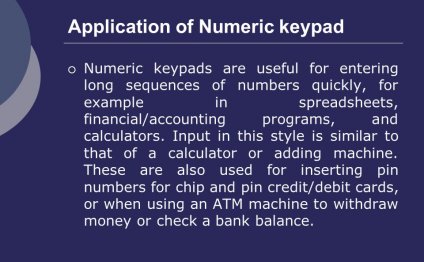

Financial Accounting Programs

The curriculum comprises 4 required courses and 12 semester units of electives for a total of 24 semester units (360 hours of instruction). Candidates must pay a nonrefundable certificate registration fee.

You must take all courses for a letter grade. To receive the certificate, you must maintain an overall minimum 2.5 grade point average, with a grade of C or better in each course. A Certificate With Distinction will be awarded to those who complete the certificate with a GPA of 3.7 or higher. All coursework must be completed within five years of registering for the certificate. Most students take one-and-a-half years to complete the courses.

How to Register

By registering, you declare your intention to complete the curriculum. To register online for the Certificate Program in Accounting, complete these two steps:

- Pay the nonrefundable registration fee through your shopping cart. Please allow 3–5 business days for the registration to appear in your student account.

Estimated Cost

Each course is priced individually, and you pay the course fee at the time of enrollment. The certificate has an estimated cost of $7, 225 (not including course materials or registration fee). Course fees are subject to change.

Certificate and Award Request

Once you have completed the certificate coursework, notify UC Berkeley Extension that you have completed the curriculum and request your certificate. Send an email to extension-business@berkeley.edu or call (510) 642-4231. After your records have been reviewed, verified and approved, your certificate will be sent to you in the mail. The review of your records is usually completed within six to eight weeks after you request the certificate.

Additional Information

CPA Licensure Requirements

Information about Certified Public Accountant (CPA) and Certified Management Accountant (CMA) licensing and renewal requirements is available at:

MBA Programs

Some of our courses may fulfill prerequisites for M.B.A. programs. Please note that acceptance of transfer credit is always at the discretion of the accepting institution; contact the schools to which you are applying for information about transfer of credits earned at UC Berkeley Extension.

Advisory Board

John Finegan

Senior Consultant

Financial Leadership Group

Maricela Frausto

Audit Senior Manager

KPMG LLP

Tom Hoster

Financial Consultant

Former CFO

Susan Klein

CPE Director, California Society of CPAs

Cal CPA Education Foundation

Harry Lorsbach

Adjunct Professor, UC Berkeley Extension

Internal Auditor, Berkeley National Labs

Maria Nondorf

Executive Director

Center for Financial Reporting and Management

Haas School of Business

UC Berkeley

Suzann Sylvester

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting problems

Description: The Journal of Accounting Research publishes original research using analytical, empirical, experimental, and…

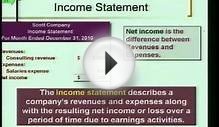

Read MoreFinancial Accounting Solutions

Reducing total financial department administration costs while enhancing service levels and transparency is a critical goal…

Read More