Free online Financial Accounting Courses

Syllabus

Week 1: Introduction and Balance SheetTo learn a foreign language like Accounting, you need quite a bit of practice in the basic foundations (grammar, syntax, idioms, etc.). This material is absolutely essentially for being able to read and to understand books written in the language (in our case, financial statements.). This week, we will starting building these foundations. We will start with an overview of financial reporting. What types of reports are required? Who makes the rules? Who enforces the rules? Then, we will cover the balance sheet equation and define/discuss Assets, Liabilities, and Stockholders' Equity. We will introduce debit-credit bookkeeping and do lots of practice in translating transactions into debits and credits. Finally, we will introduce a case of a start-up company to provide you insights into all of the steps necessary to go from recording the first transactions of a new business all the way through its first set of financial statements.

Week 2: Accrual Accounting and the Income Statement

We will start with a discussion of Accrual Accounting and how it affects the recognition of the Income Statement accounts: Revenues and Expenses. Then, we will cover adjusting entries, which are needed to prepare our internal books for the upcoming financial statements. Finally, we will discuss closing entries and the preparation of the Balance Sheet and Income Statement. At each stage, we will continue to work on the case of our start-up company. If you are not sick and tired of journal entries by the end of this week, then I have not done my job!

Week 3: Cash Flows

Cash is King! We will start with the classification of cash flows into operating, investing, and financing activities. Then, we will work on preparing and analyzing the Statement of Cash Flows. We will wrap up the case on the start-up company by preparing and analyzing its Statement of Cash Flows. Finally, we will discuss the differences between Earnings, Cash from Operations, EBITDA, and Free Cash Flow.

Week 4: Ratio Analysis and Final Exam

We will have our final exam this week. Because of the exam, I will cover Ratio Analysis, which will not involve any "new" material. While we will define and discuss a number of ratios, they will all basically involve dividing one accounting number by another. But, the analysis of what those ratios mean will involve a deep understanding of Balance Sheet and Income Statement accounts. Thus, the Ratio Analysis videos will help provide a nice review of the material, which will help you prepare for the exam. However, there will be no questions about ratio analysis on the exam. The only thing left to do after this exam is to impress your family, friends, and co-workers with your vast knowledge of Financial Accounting!

YOU MIGHT ALSO LIKE

Share this Post

Related posts

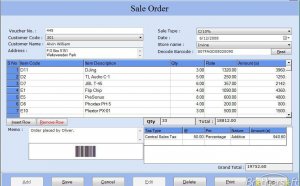

Free Financial Accounting software

When we say free, we actually mean free: You don t pay a thing for our free tools, no matter how much you use them. Not just…

Read MoreRelevance in Financial Accounting

In accounting, the term relevance means it will make a difference to a decision maker. For example, in the decision to replace…

Read More