Accounting Audit process

Steps

Method 1

Preparing To Perform a Basic Financial Audit- Understand financial audits. Quite simply, financial audits exist to ensure that your business's financial information is "true and fair". For small businesses, the main concern is that all expenses and revenues are accurate so that the IRS knows exactly the financial status of the business and can confirm all deductions are valid.

- A formal audit involves an examination of financial statements by a qualified third-party (typically a chartered public accountant, or CPA). With regards to small businesses, audits are typically performed by the IRS due to concerns over proper reporting, whereas large public corporations typically hire external auditors (and have internal auditors) to confirm financial information is valid for shareholders..

- Despite this, you can still "self-audit" your business (or make sure your financial information and procedures are accurate and fair), to improve your business and protect yourself from an IRS audit.

- Learn the reasons for a financial audit. There are several reasons and benefits to regularly audit your finances. While a basic audit can be performed by the business owner (who should be regularly making sure financial information is accurate and procedures are efficient), it is wise to hire a CPA to do a systematic overview of your finances.

- Financial audits can ensure information is valid and in accordance with accounting standards (like the Generally Accepted Accounting Principles, or GAAP).

- Financial audits make sure all legal and tax rules are being complied with, which can prevent an audit from the IRS, or different legal issues that can arise when fraudulent or incorrect information is presented to the public or investors.

- They can also provide education to the business owner about how their business is running and how it can be improved.

- Prevent your small business from triggering an IRS audit. A basic accounting audit of your business can be an effective way to prevent yourself from receiving an IRS audit, which can be stressful and time consuming. Before looking deeper into your finances, there are several initial tips that can be used to improve your financial standing and prevent an IRS audit.

- Ensure your deductions are realistic and not excessive (especially for business meals, travel, and entertainment). For example, daily commuting to work at a regular job is not a valid deduction, nor is claiming any personal expense as a business deduction. A good rule is if the spending is required to make money, then it can be deducted.

- Be sure you have proper receipts and records for any and all deductions.

- Have explanations and proper documentation for any major discrepancies between years. If you contribute much more to charity one year than another, include an explanation as to why when you file your return, and include any receipts or other associated documents.

YOU MIGHT ALSO LIKE

The Audit Process, Planning, and Risk Analysis - Prof ...

The Role of Auditors in the Accounting Process

Integral Accounting Audit Process

Share this Post

Related posts

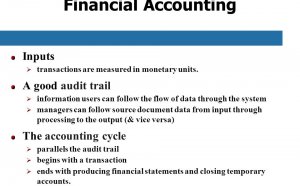

Accounting Audit trail

DECEMBER 23, 2025

An accounting audit trail strikes at the underlying conditions - fraud, data incompleteness and missing information - that…

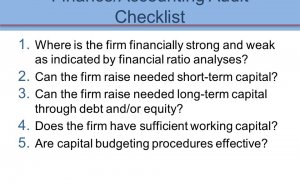

Read MoreAccounting Audit Checklist

DECEMBER 23, 2025

Auditors use checklist to ensure efficiency. Stockbyte/Stockbyte/Getty Images An audit engagement is a critical exercise…

Read More