Accounting Audit trail

An accounting audit trail strikes at the underlying conditions - fraud, data incompleteness and missing information - that breed inaccurate financial reporting. By giving corporate auditors fodder for analysis and review, the data trail improves chances that auditors will detect instances of inappropriate record-keeping behaviors, unlawful business practices and mathematical inaccuracies in period-end accounting records.

Definition

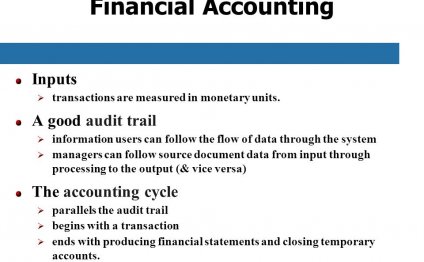

An accounting audit trail incorporates all paperwork and electronic evidence that shows the operational journey a transaction goes through from the day corporate personnel sign the underlying contract to the time the transaction makes it into financial statements. Simply put, an audit trail gives a step-by-step history of a transaction, touching on documents as diverse as vendor bills, customer invoices, contractual agreements, sales slips, bills of lading and accounting journals. The latter items constitute documents in which bookkeepers record transactional data, usually via debits and credits of financial accounts - such as assets, equity items, revenues, debts and revenues.

Internal Controls

A sound, reliable audit trail typically draws on corporate internal controls that are effective, adequate, adapted to operating activities and in line with regulatory guidelines. A control is a medley of policies, procedures and mechanisms a company relies on to prevent operating losses that may arise from various events. These include computer systems' breakdowns, regulatory scolding and the ensuing hefty fines and non-monetary penalties, human errors and negligence, and asset misappropriation. Effective controls fix the underlying problems for which corporate management established them in the first place. Procedures are adequate if they provide clear instructions on how subordinates must execute tasks, report problems, clean them up, seek hierarchical guidance and make on-the-job decisions.

Related Reading: What Is an Audit Trail and Why Is It Important in Accounting?

Personnel Involvement

Various corporate personnel help maintain internal controls that top leadership has established, making sure department heads don't miss the boat on important events that happen in operating activities. By ensuring conformity with internal procedures, auditors, financial managers and regulatory compliance specialists help supervisors know what's going in day-to-day activities. Accountants, human resources managers and in-house counsel also weigh in on audit trail discussions, ensuring that a company's leadership is aware of significant events and can take real-time, appropriate actions to remedy potential problems.

Tools and Technology

In the modern economy, technology plays a key part in the way a company maintains an effective audit trail to ease the work of internal and external reviewers. The tools of the trade include practical extraction and reporting language, or PERL, software; risk assessment programs; transaction security and virus protection software; backup and archival software; and defect-tracking applications. Other tools include categorization or classification software, calendar and scheduling software, and mainframe computers.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Accounting Audit process

Steps Method 1 Preparing To Perform a Basic Financial Audit Understand financial audits. Quite simply, financial audits exist…

Read MoreAccounting Auditing firms

Audit & accounting services assure your company’s compliance with requirements of applicable laws, financial reporting…

Read More