Reconciliation Of Cost And Financial Accounts

In business realm, reconciliation may be represented as process of tallying the working results or profit as shown by cost accounts with that of financial account. Eric Kohler described that reconciliation is the determination of the items necessary to bring the balances of two or more related accounts or statements into agreements. Therefore Reconciliation and Integration between financial and cost accounts involve the process of recognizing and accounting for the items which have led to the difference in working results as revealed by cost and financial accounts. The reconciliation is made in an analytical form presented in the shape of statement or memorandum account (Narsis, 2009).

Cost and financial accounts are maintained separately, the difference between the end result of these two are required to be reconciled. Reconciliation of cost and financial accounts entail totalling the profit or loss revealed by both set of accounts. The principal aim of reconciliation is to find out the grounds for the difference between the results shown by Cost Accounts and Financial Accounts. Reconciliation of Cost and Financial Accounts is process to find all the reasons behind difference in profit which is calculated as per cost accounts and as per financial accounts. There are various items which are revealed in the profit and loss account only when accountants make it as per financial accounting rules. There are lots of items which are shown in costing profit and loss account only when they calculate profit as per cost accounting.

Importance of Reconciliation

Reconciliation of cost and financial account is needed for various reasons:

- To ensure arithmetical accuracy of both set of accounts for effective cost ascertainment and cost control.

- Reconciliation of cost and financial account is required to identify the reasons for different results in two sets of accounts.

- It facilitates internal control since it discloses the reasons for variations for effective internal control.

- Reconciliation of cost and financial account is needed to enable the smooth co-operation and co-ordination between the activities of cost and financial accounting departments.

- Reconciliation of cost and financial account is essential to make certain the standardization of policies relating to stock valuation, depreciation and absorption of overheads.

It is shown in literature that Reconciliation assist in ascertaining the accuracy and reliability of various sets of books of account maintaining in business concern (Narsis, 2009).

The discrepancy between financial and costing results may be due to numerous reasons.

- First is items shown only in financial results but no place in cost accounts. These may be items of expenditure or items of income or appropriation of profits. Such items are grouped under headings:

- Purely financial charges: These includes discount of debentures, loses on the sale of fixed assets, loses on investments, interest on bank loans mortgages and debentures, expenses of the company's share transfer office.

- Purely financial incomes: These are profits on the sale of fixed assets, transfer fee received, dividend received, interest received on the bank deposits, loans, rent received commission received.

- Appropriation of profits: These are income tax and super tax, dividends paid, transfers to reserves or sinking funds, donations and charities, amount of written off goods and preliminary expenses.

- Items shown only in cost account: There are certain items which are included in cost account but not in financial account. These items are very few and are usually notional charges such as interest on capital employed in production but not paid, nominal rent charges of premises owned by the concern.

- Over and under observed option of overhead in cost account: Overhead observed in cost account may be more or less than actual amount spent, if overhead expenses in cost accounts are more than actual. It is called over absorption. If overhead expenses in cost accounts are less than actual, it is termed as under absorption of overheads and leads to difference in two accounts. In such cases, costing profits will be higher and reconciliation is required.

- Different base of stock valuation of material: In the financial accounts, stocks are values at cost or market price whichever is lower. But in cost accounts, stocks of material are valued at cost. In financial accounts, stocks of finished goods are normally valued at prime cost. In cost accounts, however, they are valued at prime cost with appropriate proportion of production and administrative overheads. The difference in basis of valuation of stocks of material and finished goods may cause variations therefore reconciliation is needed.

- Abnormal wastages: Abnormal wastages of material and time is included in financial account but excluded from cost account. Reconciliation of profit and loss of cost account with that of financial account is done by means of memorandum reconciliation or simply by reconciliation statement (Narsis, 2009).

Methods of Reconciliation

YOU MIGHT ALSO LIKE

Share this Post

Related posts

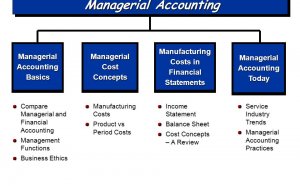

Managerial and Financial Accounting

Managerial finance is the branch of finance that concerns itself with the managerial significance of finance techniques…

Read MoreMcGraw Hill Financial and Managerial Accounting

Financial and Managerial Accounting, 16/e Jan R. Williams, University of Tennessee Sue F. Haka, Michigan State University…

Read More