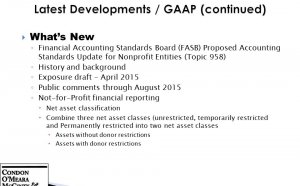

Financial Accounting Standards Board definition

Share this Post

Related posts

Financial Accounting Standards Board History

FEBRUARY 22, 2026

Since 1973, the Financial Accounting Standards Board (FASB) has been the designated organisation in the private sector for…

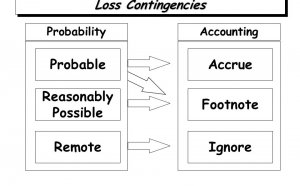

Read MoreFinancial Accounting Standards No. 5

FEBRUARY 22, 2026

Presentation Chapter 13-1 Current Liabilities and Contingencies

Read More