Financial Accounting income Statement

The income statement is one of the major financial statements used by accountants and business owners. (The other major financial statements are the, , and the .) The income statement is sometimes referred to as the profit and loss statement (P&L), statement of operations, or statement of income. We will use income statement and profit and loss statement throughout this explanation.

The income statement is important because it shows the profitability of a company during the time interval specified in its heading. The period of time that the statement covers is chosen by the business and will vary. For example, the heading may state:

Keep in mind that the income statement shows revenues, expenses, gains, and losses; it does not show cash receipts (money you receive) nor cash disbursements (money you pay out).

People pay attention to the profitability of a company for many reasons. For example, if a company was not able to operate profitably—the bottom line of the income statement indicates a —a banker/lender/creditor may be hesitant to extend additional credit to the company. On the other hand, a company that has operated profitably—the bottom line of the income statement indicates a —demonstrated its ability to use borrowed and invested funds in a successful manner. A company's ability to operate profitably is important to current lenders and investors, potential lenders and investors, company management, competitors, government agencies, labor unions, and others.

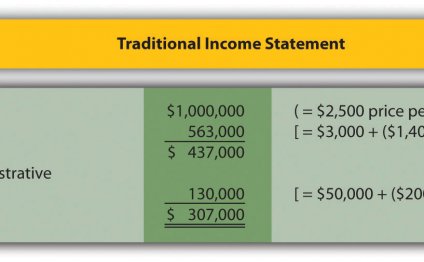

The format of the income statement or the profit and loss statement will vary according to the complexity of the business activities. However, most companies will have the following elements in their income statements:

A. Revenues and Gains

1. Revenues from

2. Revenues or income from

3. Gains (e.g., gain on the sale of long-term assets, gain on lawsuits)

B. Expenses and Losses

1. Expenses involved in primary activities

2. Expenses from secondary activities

3. Losses (e.g., loss on the sale of long-term assets, loss on lawsuits)

If the net amount of revenues and gains minus expenses and losses is positive, the bottom line of the profit and loss statement is labeled as net income. If the net amount (or bottom line) is negative, there is a net loss.

Note: We provide business forms for preparing income statements plus a visual tutorial and exam questions pertaining to the income statement for members of .

A. Revenues and Gains

1. Revenues from primary activities are often referred to as operating revenues. The primary activities of a retailer are purchasing merchandise and selling the merchandise. The primary activities of a manufacturer are producing the products and selling them. For retailers, manufacturers, wholesalers, and distributors the revenues resulting from their primary activities are referred to as sales revenues or sales. The primary activities of a company that provides services involve acquiring expertise and selling that expertise to clients. For companies providing services, the revenues from their primary services are referred to as service revenues or fees earned. (Some people use the word income interchangeably with revenues.)

It's critical that you don't confuse revenues with . Under the, service revenues and sales revenues are shown at the top of the income statement in the period they are earned or delivered, not in the period when the cash is collected. Put simply, revenues occur when money is earned, receipts occur when cash is received.

For example, if a retailer gives customers 30 days to pay, revenues occur (and are reported) when the merchandise is to the buyer, not when the cash is received 30 days later. If merchandise is sold in December, the sale is reported on the December income statement. When the retailer receives the check in January for the December sale, the retailer has a January receipt—not January revenues.

Similarly, if a consulting company asks clients to pay within 30 days of receiving their service, revenues occur (and are reported) when the service is performed (earned), not 30 days later when the consulting company receives the cash from the client.

If an attorney requires a client to prepay $1, 000 before beginning to research the client's case, the attorney has a receipt, but does not have revenues until some of the research is done.

If a company sells an item to a buyer who immediately pays for it with cash, the company has both a receipt and revenues for that day—it has a cash receipt because it received cash; it has sales revenues because it sold merchandise.

By knowing the difference between receipts and revenues, we make certain that revenues from a transaction are reported only once—when the primary activities have been completed (and not necessarily when the cash is collected).

Let's reinforce the distinction between revenues and receipts with a few more examples. (Keep in mind that all of the examples below assume the accrual basis of accounting.)

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting and Management

Financial accounting is een tak binnen de accountingwereld die zich bezighoudt met de voorbereiding van financiële overzichten…

Read MoreFinancial Accounting Management

Definition: Management accounting involves preparing and providing timely financial and statistical information to business…

Read More