Financial account Aggregation

If you're thinking about account aggregation, consider these factors.

If you're thinking about account aggregation, consider these factors.

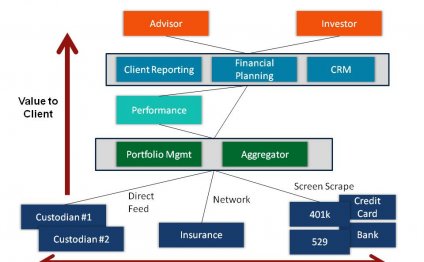

Account aggregation technology has been available in various forms for many years. When account aggregation was first introduced, the primary method was through “screen scraping.” Using the client's login credentials, this technology would essentially capture the account information displayed on the financial institution's website. This process was very error prone and cumbersome. Now, account aggregation providers have more direct data feeds with various financial institutions, and they leverage new technology to better parse the information from a website.

The technology a provider uses is only one of several factors that determine its usefulness. Let's look at some of the other factors advisors should consider when deciding how to introduce an account aggregation solution.

The first question to ask is whether your firm should offer an account aggregation solution at all. The answer depends on your type of firm and clients, and, ultimately, whether providing a complete picture of your clients’ overall net worth is valuable. Many advisors want to provide this holistic view of information, which helps them offer better financial planning and investment allocation. That being said, a pure money management firm might decide that offering such a tool is not important. I would argue that the number of clients who want some type of account aggregation will increase, regardless of the type of firm they work with.

The next question is, “What type of data repository is used for aggregated accounts?” For many advisors, their performance reporting solution will be their first choice. Your system probably already offers several dozen custodian data connections. On the high end of the list is Advent's Custodial Data (ACD), which offers more than 800 connections to external providers.

With so many custodial connections available, a data aggregation system may not be needed, but if your performance reporting solution does not offer a connection you are looking for, you can consider working with an external aggregation company like ByAllAccounts or AllData Aggregation. These companies offer connections to accounts at thousands of different financial services companies.

Another option is using your financial planning system. For example, last year, MoneyGuidePro announced that Yodlee is available for account aggregation on their platform. Yodlee, one of the first companies to offer large-scale account aggregation, has connections to over 12, 000 different financial services companies. Another system is Finance Logix, which retrieves data from a number of financial services companies, reporting systems and other account information systems.

A third option is a solution like eMoney or Wealth Access, which focus primarily on account aggregation. Though eMoney offers several features, many advisors leverage the account aggregation. These providers generally start with retrieving account information from “reconciled” systems like your CRM, then use their aggregation services to gather data on external accounts.

Your clients may even be using a system on their own, like Mint.com. These providers might not charge a direct fee, but often their terms of use allow them to use account data to “offer” new services and products to the client. Don't be surprised if you have a client who starts asking questions about potential “other” investment options.

There are many challenges for advisors who offer an account aggregation solution, but when done well, it can be a useful benefit for your clients and provide your firm with a holistic view of your clients’ financial affairs.

Be Careful How You Get the Account Data

A very common practice in the past and still a habit today, advisors often use their client's login credentials to retrieve information for external accounts. This is not a good idea. It can raise compliance issues because knowing and using these credentials often gives you the ability to transact business on these accounts, which you may not have the authority to do. Furthermore, if your clients’ login credentials are ever compromised (identity theft, fraud, etc.), your firm is in the mix in discovering how it happened.

The good news is that now many account aggregation providers offer a feature that allows your clients to enter their login credentials (if required) directly on the system without having to share this information with your firm. Essentially, the external account information is retrieved without creating new risks and compliance issues for your firm.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

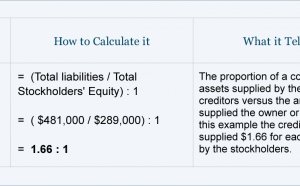

Financial Accounting ratios

Accounting ratios (also known as financial ratios) are considered to be part of financial statement analysis. Accounting…

Read MoreFinancial Accounting Solutions

Reducing total financial department administration costs while enhancing service levels and transparency is a critical goal…

Read More