Conceptual Framework of Financial Accounting

By Carol Wiley, Accountingedu contributing writer

Updated April 2013

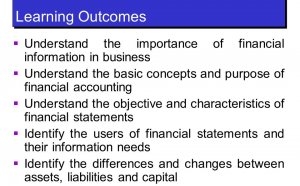

Financial accounting concepts are the basic principles used in the preparation of financial statements.

Financial Statements

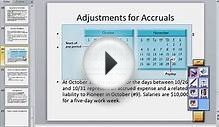

The concept of the accounting period is an important one for financial statements. An accounting period is the interval of time during which accounting activities are measured. Common accounting periods include monthly, quarterly, and annually.

The four most important financial statements in accounting are:

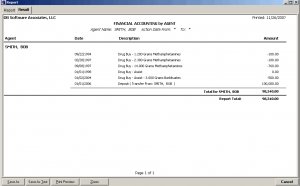

- Income statement: Summarizes financial results for an accounting period. Revenues - Expenses = Income.

- Balance sheet: Lists the assets and liabilities at the end of an accounting period. Assets = Liabilities + Equity.

- Cash flow statement: Shows the actual flow of cash into and out of an organization during the accounting period.

- Statement of retained earnings: Shows the dividends paid from earnings to shareholders and the earnings kept (retained) by the company.

Financial Accounting Concepts

Accounting concepts for preparing financial statements include:

- Conservatism (also called prudence): If a financial result can be reported in two ways, the least beneficial way is used.

- Consistency: An organization should use the same accounting method over time, and not change accounting methods between accounting periods.

- Cost principle: Accounts and financial statements show the actual cost of an asset, rather than the current value.

- Dual aspect: Every transaction involves at least two accounts.

- Going concern: The assumption is that an organization will continue into at least the near future.

- Matching: When a transaction affects both revenues and expenses, the effect on financial statements should occur in the same accounting period.

- Materiality: While an organization needs to disclose all relevant information on financial statements, insignificant events need not be disclosed.

- Money (or monetary) measurement: Only transactions that can be quantified in actual amounts of money are included on the financial statements.

- Realization: An organization recognizes revenue when shipping goods or rendering services, not when payment is received.

- Separate Entity: A clearly defined business unit is used for financial reporting purposes.

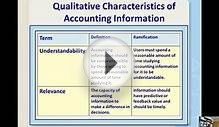

Other important concepts concerning accounting information include the need for the information to be understandable, timely, relevant, reliable, and complete so as to serve as an objective representation of an organization’s financial status.

Sometimes, these concepts may come into conflict; in which case, it’s the accountant’s job to decide which concept to follow, based on the needs of the users of the financial information, whether this be financial regulators or internal managers.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Summary of Financial Accounting

Financial summaries can reveal the successes and failures of a business. The summaries gather data from accounting records…

Read MoreImportance of Financial Accounting in Business

Rigorous accounting requires time and effort, but your business won t remain viable without it. Jupiterimages/Comstock/Getty…

Read More