Georgia Department of Audits and Accounts

The State of Georgia has over 700 local governments including 159 counties and approximately 535 cities which submit audited financial statements to the State Auditor. These audited financial statements are required by the Official Code of Georgia Annotated, Section 36-81-7. This code section also requires the State Auditor review these financial statements to ensure compliance with generally accepted accounting principles, generally accepted government auditing standards, and federal and state regulations.

Local governments are strongly encouraged to submit audited financial statements electronically using our Local Government Audit Report Collection System. Instructions for using the system are available from the following link:

Local governments which do not submit acceptable audit reports to the State Auditor are subject to the provisions of state law that "No state agency shall make or transmit any state grant funds to any local government which has failed to provide all the audits required by law within the preceding five years." The most recent listing of noncompliant local governments and transmittal memo to state agency heads is available in the link below this paragraph. It is important to note that a particular government's compliance status is subject to change. Inclusion on or exclusion from the listing is not indicative of a local government's current compliance status. State grantor agency officials are urged to contact the Local Government Division to verify potential grantees' eligibility to receive state grant fund transmittals prior to grant award and transmittal. Please contact the Local Government Division at (404) 656-9145 or email locgov

Georgia law defines the extent of local government financial reporting requirements based on the government's level of annual expenditures. The State Auditor has developed an array of documents to assist local governments in fulfilling their financial reporting requirements.

Local governments in Georgia having annual expenditures of $300, 000 or more are required to have an annual audit. Local governments with less than $300, 000 in expenditures may elect, in lieu of an annual audit, to provide for an annual report of agreed upon procedures or a biennial audit covering both years. The audit report or report of agreed upon procedures is required by state law to be submitted to the State Auditor for review. If the report contains any findings or recommendations, the local government is also required to submit written comments on the findings and recommendations, including a corrective action plan, to the State Auditor for review. The specific requirements are established in OCGA 36-81-7. The State Auditor has developed several documents to assist local government officials and certified public accountants performing audits of local governments. These documents can be viewed in the Audit and Accounting Resource Library in either HTML or PDF format.

If you have any questions regarding the content of the Division's Home Page, please send us an email to receive a prompt reply or call (404) 656-2180 and indicate that you have a local government question.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

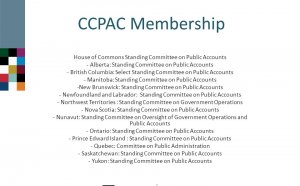

Joint Committee of Public Accounts and Audit

Public Accounts Committee (PAC) refers to a committee in the legislature that must study public audits, invite ministers…

Read MoreFinancial and Managerial Accounting for MBA

Peter D. Easton Peter D. Easton is an expert in accounting and valuation and holds the Notre Dame Alumni Chair in Accountancy…

Read More