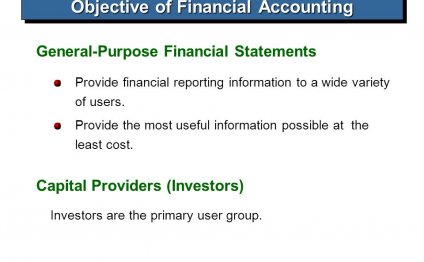

What are the objectives of Financial Accounting?

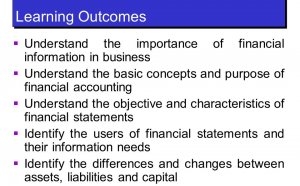

AccountingInvolves the creation of financial records of business transactions, flows of finance, the process of creating wealth in an organisation, and the financial position of a business at a particular moment in time.

AccountingInvolves the creation of financial records of business transactions, flows of finance, the process of creating wealth in an organisation, and the financial position of a business at a particular moment in time.

Users of Accounts

A number of users make use of accounts for different purposes: these are also refered to as stakeholders. The main users of accounts are shown below:

Shareholders read accounts to examine the health of business, and the returns (dividends) that they can expect to make. Employees read accounts to see how safe their jobs are. The Inland Revenue read accounts to calculate how much tax businesses should be paying. Suppliers read accounts to check that the company they supply with goods on credit will be able to pay the money owed when it becomes due.

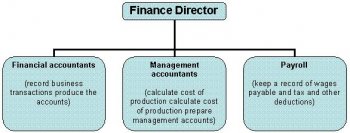

In a typical large business the accounting function might be organised in the following way:

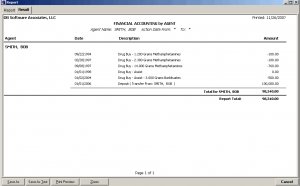

Financial accounting is concerned at one level with book-keeping i.e. recording daily financial activities, and at a more advanced level with preparation of the final accounts e.g. the profit and loss account and balance sheet.

Management accounting is concerned with providing managers with management information such as information about costs, and forecasts of future costs and revenues. Financial information can be fed to those who require such information for decision-making and record-keeping purposes.

For example, managers need information in order to manage the business efficiently and constantly to improve their decision-making capabilities. This is especially true when analysing accounts using ratios. Shareholders need to assess the performance of managers and need to know how much profit of income they can take from the business. Suppliers need to know about the company's ability to pay its debts and customers wish to ensure that their supplies are secure. Any provider of finance of the business (e.g. bank) will need to know about the company's ability to make repayments. The Inland Revenue needs information about profitability in order to make an accurate tax assessment. Employees have a right to know how well a company is performing and how secure their futures are. This helps towards the employer - employee relations.

Four Reasons

The reasons why businesses keep accounts for these users can therefore be summarised as:

1. To comply with legal and other requirements e.g. Stock Exchange listing rules.

2. To provide information for stakeholders about financial performance and viability.

3. To provide managers with information for decision making.

4. To provide a structure to business activity based on the careful processing of numerical data.

Public limited companies like Cadbury-Schweppes and Polestar produce an annual report including a set of financial statements. These statements are produced in line with a number of UK and international accounting standards, and provide users with a clear picture of business performance over the previous year (through the Profit and Loss Account) as well as a clear picture of the financial position of the business at the end of the financial year (in the Balance Sheet).

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Summary of Financial Accounting

Financial summaries can reveal the successes and failures of a business. The summaries gather data from accounting records…

Read MoreImportance of Financial Accounting in Business

Rigorous accounting requires time and effort, but your business won t remain viable without it. Jupiterimages/Comstock/Getty…

Read More