Management Vs. Financial Accounting

Accounting vs Financial Management

Accounting vs Financial Management

Financial Management is a relatively new branch of accounting, that manages the finances of a particular individual, business, or organization. The main aim of the discipline is to achieve various financial objectives. It also involves the company’s financial resources for management purposes.

Its key objectives are to create or improve the financial health of the organization, either by generating cash, or by adding related resources. It should study and devise plans for implementation, in order to provide a satisfactory return on investment. Financial management considers all factors, such as risks, of which it tries to manage, and how many resources are invested. Basically, financial management makes plans to ensure a productive cash flow. It governs and maintains the financial assets of a certain body. Apparently, the main concern is not the techniques of quantifying finances, but the assessment thereof. Financial management is often referred to as the science of money management.

The three elements of financial management are: Financial planning, Financial Control, and Financial Decision-making. Planning often deals with funding as any management should, ensuring that adequate funding is available at the right moment. Financial control, on the other hand, ensures that the individual’s assets, or company’s assets, are secure, and being utilized efficiently. Obviously, financial management deals with various financial decisions, particularly the things relating to financing, dividends, and investments.

According to the American Institute of Certified Public Accountants (AICPA), accounting is defined as: “The art of recording, classifying, and summarizing in a significant manner, and in terms of money, transactions, and events, which are, in part at least, of financial character, and interpreting the results thereof.”

The practice is, in fact, ancient. Archaic accounting records have been found, and they are more than 7, 000 years old. Not surprisingly, the methods of accounting used then were primitive, and they were mainly done to record the development of crops, or the increase of herds. Nowadays, accounting has evolved, and become an important part of businesses.

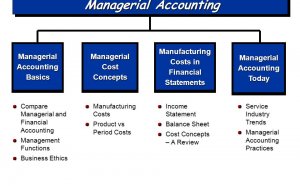

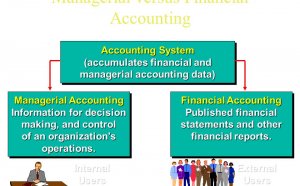

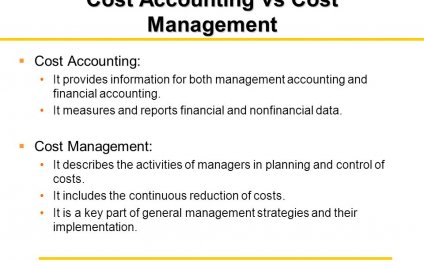

Accounting, nowadays, is considered as ‘the language of business’. It is means to report financial data or information about a particular business entity or individual. There are two main types of accounting ‘“ management accounting and financial accounting. If an accounting report is focused on individuals within the organization, it is considered as management accounting. In management accounting, information is provided to employees, auditors, owners, managers, etc. The report is used as a basis for making managerial or operational decisions.

The other type of accounting is financial accounting, in which the information provided is for people outside of the organization or business, such as, creditors, potential shareholders, economists, government agencies, and analysts.

Summary:

1. Accounting is more about reporting the financial information of a particular individual, or business entity.

2. Financial management encompasses everything that involves finances, assets, and resources. It takes part in financial planning, control, and decision-making.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Managerial and Financial Accounting

Managerial finance is the branch of finance that concerns itself with the managerial significance of finance techniques…

Read MoreManagerial versus Financial Accounting

Managerial accounting provides internal reports tailored to the needs of managers and officers inside the company. On the…

Read More