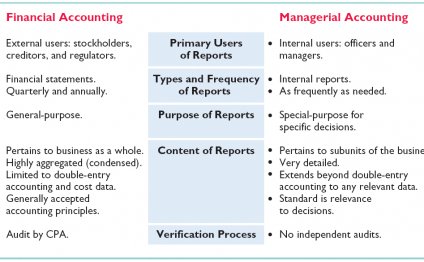

Managerial Accounting as compared to Financial Accounting

What you do and what you tell people you do should be different things. Not because you should be lying about what you do, but because what you do is complicated and specific. What you tell people is simple and general. Management accounting is the day-to-day of accounting and is what most small businesses think of when they think about their finances. Financial accounting is what you show your banker or inventors.

The distinction between the two accounting methods can be boiled down to this – the bank doesn’t care that Joe bought the expensive toner, you do.

Management accounting

If you can only manage one kind of accounting, management accounting is the way to go. The goal of management accounting is to give you the information about your business that you need to make better business decisions.

You want to know where your cash is going, how much more you’ll have coming in, and what you can do to make more money. Management accounting gives you the tools to make smarter decisions about the future of your business.

Basically, management accounting is going to help you build a valuable budget. You can build these on a daily, weekly, or yearly basis. If you decide you never want to dive into accounting, you can just never do it.

I do not recommend this option, but no one can make you take part in management accounting.

Financial accounting

Financial accounting is usually foisted upon you. Investors and bankers need this information, and in many cases, you’ll be legally required to provide it. Financial accounting is very regimented, being overseen by regulatory bodies, like the SEC in the USA.

With financial accounting, you’re explaining where all the money went. You’re looking back at the previous period, organizing everything you did with your cash, and presenting it all in a concise format.

A great example of financial accounting can be found in publicly traded companies’ annual 10-K filings – here’s Coke’s, as an example. About fifty pages in, you’ll get a summary of Coke’s fiscal 2014 income. It’s broken down into a few classic lines, like revenue, costs, gross margin, etc. In the US, the SEC mandates using generally accepted accounting principles (GAAP) for this reporting.

If you’re company isn’t beholden to anyone, you can probably – talk to your accountant – skip financial accounting. In actuality, when tax time comes around, you’ll basically be building these reports to send off to the IRS anyways.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Introduction to Financial Accounting Horngren

There are some good parts in this book, but its will be mostly useless to SERIOUS BEGINNERS of accounting. Read my review…

Read MoreIntroduction to Financial Accounting Solutions

During the course of regular business, it is not uncommon to provide credit to some customers. Once a business provides an…

Read More