Financial statements in Accounting

A complete set of financial statements is used to give readers an overview of the financial results and condition of a business. The financial statements are comprised of four basic reports, which are as follows:

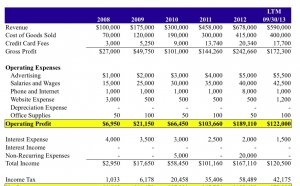

- Income statement. Presents the revenues, expenses, and profits/losses generated during the reporting period. This is usually considered the most important of the financial statements, since it presents the operational results of an entity.

- Balance sheet. Presents the assets, liabilities, and equity of the entity as of the reporting date. Thus, the information presented is as of a specific point in time. The report format is structured so that the total of all assets equals the total of all liabilities and equity (known as the accounting equation). This is typically considered the second most important financial statement, since it provides information about the liquidity and capitalization of an organization.

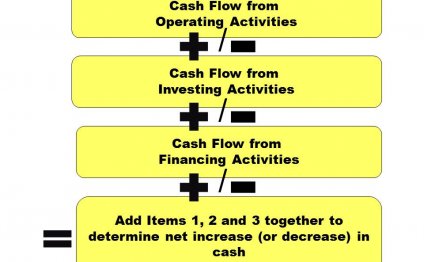

- Statement of cash flows. Presents the cash inflows and outflows that occurred during the reporting period. This can provide a useful comparison to the income statement, especially when the amount of profit or loss reported does not reflect the cash flows experienced by the business. This statement may be presented when issuing financial statements to outside parties.

- Statement of retained earnings. Presents changes in equity during the reporting period. The report format varies, but can include the sale or repurchase of stock, dividend payments, and changes caused by reported profits or losses. This is the least used of the financial statements, and is commonly only included in the audited financial statement package.

When the financial statements are issued internally, the management team usually only sees the income statement and balance sheet, since these documents are relatively easy to prepare.

The four basic financial statements may be accompanied by extensive disclosures that provide additional information about certain topics, as defined by the relevant accounting framework (such as generally accepted accounting principles).

YOU MIGHT ALSO LIKE

Share this Post

Related posts

What are Financial statements in Accounting?

The required financial statements for U.S. business corporations are: Statement of income. This financial statement is also…

Read MoreWhat is Financial statements in Accounting?

Consolidated financial statements combine the financial statements of separate legal entities controlled by a parent company…

Read More