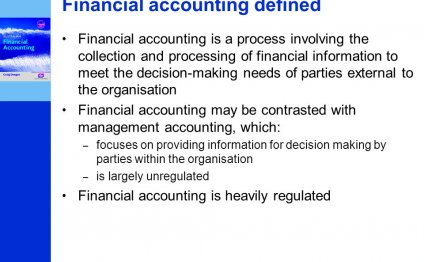

Defined Financial Accounting

The quick ratio is a more conservative version of another well-known liquidity metric - the current ratio. Although the two are similar, the quick ratio provides a more rigorous assessment of a company's ability to pay its current liabilities.

It does this by eliminating all but the most liquid of current assets from consideration. Inventory is the most notable exclusion, because it is not as rapidly convertible to cash and is often sold on credit. Some analysts include inventory in the ratio, though, if it is more liquid than certain receivables.

To demonstrate, let's assume this information was pulled from the balance sheet of our theoretical firm - Company XYZ:

Using the primary quick ratio formula and the information above, we can calculate Company XYZ's quick ratio as follows:

($60, 000 + $10, 000 + $40, 000) / $65, 000 = 1.7

This means that for every dollar of Company XYZ's current liabilities, the firm has $1.70 of very liquid assets to cover those immediate obligations.

Why it Matters:

Obviously, it is vital that a company have enough cash on hand to meet accounts payable, interest expenses and other bills when they become due. The higher the ratio, the more financially secure a company is in the short term. A common rule of thumb is that companies with a quick ratio of greater than 1.0 are sufficiently able to meet their short-term liabilities.

In general, low or decreasing quick ratios generally suggest that a company is over-leveraged, struggling to maintain or grow sales, paying bills too quickly or collecting receivables too slowly. On the other hand, a high or increasing quick ratio generally indicates that a company is experiencing solid top-line growth, quickly converting receivables into cash, and easily able to cover its financial obligations. Such companies often have faster inventory turnover and cash conversion cycles.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Learn Financial Accounting

Nano learning breaks instruction into self-contained modules that can last from two to 15 minutes. These small lessons focus…

Read MoreF3 Financial Accounting

All questions in the F3 exam are compulsory. The F3 exam contains 35 objective test (OT) questions which are each worth 2…

Read More