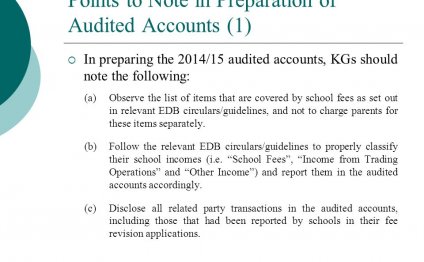

Audited Accounts

A financial statement audit is the examination of an entity's financial statements and accompanying disclosures by an independent auditor. The result of this examination is a report by the auditor, attesting to the fairness of presentation of the financial statements and related disclosures. The auditor's report must accompany the financial statements when they are issued to the intended recipients.

The purpose of a financial statement audit is to add credibility to the reported financial position and performance of a business. The Securities and Exchange Commission requires that all entities that are publicly held must file annual reports with it that are audited. Similarly, lenders typically require an audit of the financial statements of any entity to which they lend funds. Suppliers may also require audited financial statements before they will be willing to extend trade credit (though usually only when the amount of requested credit is substantial).

Audits have become increasingly common as the complexity of the two primary accounting frameworks, Generally Accepted Accounting Principles and International Financial Reporting Standards, have increased, and because there have been an ongoing series of disclosures of fraudulent reporting by major companies.

The primary stages of an audit are:

1. Planning and risk assessment. Involves gaining an understanding of the business and the business environment in which it operates, and using this information to assess whether there may be risks that could impact the financial statements.

2. Internal controls testing. Involves the assessment of the effectiveness of an entity's suite of controls, concentrating on such areas as proper authorization, the safeguarding of assets, and the segregation of duties. This can involve an array of tests conducted on a sampling of transactions to determine the degree of control effectiveness. A high level of effectiveness allows the auditors to scale back some of their later audit procedures. If the controls are ineffective (i.e., there is a high risk of material misstatement), then the auditors must use other procedures to examine the financial statements. There are a variety of risk assessment questionnaires available that can assist with internal controls testing.

3. Substantive procedures. Involves a broad array of procedures, of which a small sampling are:

- Analysis. Conduct a ratio comparison with historical, forecasted, and industry results to spot anomalies.

- Cash. Review bank reconciliation, count on-hand cash, confirm restrictions on bank balances, issue bank confirmations.

- Marketable securities. Confirm securities, review subsequent transactions, verify market value.

- Accounts receivable. Confirm account balances, investigate subsequent collections, test year-end sales and cutoff procedures.

- Inventory. Observe the physical inventory count, obtain confirmation of inventories held at other locations, test shipping and receiving cutoff procedures, examine paid supplier invoices, test the computation of allocated overhead, review current production costs, trace compiled inventory costs to the general ledger.

- Fixed assets. Observe assets, review purchase and disposal authorizations, review lease documents, examine appraisal reports, recalculate depreciation and amortization.

- Accounts payable. Confirm accounts, test year-end cutoff.

- Accrued expenses. Examine subsequent payments, compare balances to prior years, recompute accruals.

- Debt. Confirm with lenders, review lease agreements, review references in board of directors minutes.

- Revenue. Examine documents supporting a selection of sales, review subsequent transactions, recalculate percentage of completion computations, review the history of sales returns and allowances.

- Expenses. Examine documents supporting a selection of expenses, review subsequent transactions, confirm unusual items with suppliers.

An audit is the most expensive of all the types of examination of financial statements. The least expensive is a compilation, followed by a review. Due to its cost, many companies attempt to downgrade to a review or compilation, though this is only an option if it is acceptable to the report recipients. Publicly held entities must have their quarterly financial statements reviewed, in addition to the annual audit.

Audits are more expensive for publicly-held firms, for auditors must adhere to the stricter audit standards of the Public Company Accounting Oversight Board (PCAOB), and so will pass their increased costs through to their clients.

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Financial Accounting a Managerial perspective

Presentation 1 Chapter 3 Measuring Business Income Financial

Read MoreFinancial versus Managerial Accounting

While managers are responsible for the efficient operation of a business, accountants are responsible for reporting the results…

Read More