Financial Accountant position Description

Financial accountants review books and records, create financial statements and advise management.

Financial accountants review books and records, create financial statements and advise management.

business accounts image by Nicemonkey from Fotolia.com

A financial accountant performs different functions than a public accountant. Most financial accountants work directly for companies, performing internal financially-related duties. CPAs who are "public" work for themselves or for accounting firms and perform contracted projects for a variety of organizations. Conversely, financial accountants are typically W-2 employees, working regular hours for one corporation only. They usually prepare internal financial statements, perform management duties and actively contribute to their employer's financial, operations and strategic plans.

Review Financial Records and Transactions

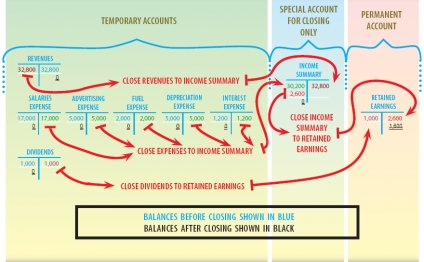

Financial accountants in smaller companies may physically make transactions to the books and records. However, in most situations, other employees record transactions, while the financial accountant reviews these entries for accuracy and proper account posting. After examining the actual transactions made over some time period, the accountant will then review the books and records to ensure they accurately reflect the operating results of the organization. These accountants also organize company books and records in preparation for the annual outside audit of the organization.

Report to Senior Management

Reports to the senior management team are important responsibilities for all financial accountants. More than financial statements, these professionals create reports for all things financial that relate to the organization. Most reports will also contain the financial accountant's evaluation of the meaning and trends shown by the documents. Using graphs and text narratives to complement the reported numbers, financial accountants interpret the impact of the accounting results on all aspects of company operations, including HR, marketing, borrowing, investment and strategies.

Advise Management

After reviewing and analyzing the company's books and records, the accountant offers feedback and advice to senior management, particularly relating to asset quality, liability position, cash flow sufficiency, and revenue/expense issues. Experienced financial accountants also provide advice on the status and use of company resources, updates on the budget and results of projections in the business plan and the latest financial news that could affect organization operations. Depending on the accountant's experience level, this professional might also advise senior management on HR, strategic planning, better control of expenditures, and/or company investments.

Tax Issues

Financial accountants are experts on local, state and federal taxes as they apply to businesses, large and small. Their tax advice to management includes recommending action plans that reduce the tax liability, tax deferred or tax free investments, non-taxable asset swaps, and cash flow planning so as to remain liquid at tax filing/paying dates, usually quarterly. Financial accountants also either prepare all tax forms and reports, or review the work of others to ensure that all tax filings are correct and timely.

Share this Post

Related posts

Financial Accountant Vacancies

Best options trading books - Sell tips you might want to first go

Read MoreGroup Financial Accountant

Financial Accountant OnApp Ltd - London E1 £45, a year An exciting venture backed software company in Tech City, London…

Read More