Understanding Financial Accounting

Basic Finance for Non-Financial Managers

© iStockphoto

wragg

Understand the basics.

It's not just accountancy specialists who deal with spreadsheets, and figures, and the financial side of business. It's highly likely that, as a line manager or department head, you're going to have to analyze a spreadsheet at some point, or have some form of financial recording to do as part of your job description.

However, if you feel baffled by balance sheets, or confused by cash flow statements, then read on. This article will take you through the basics of finance for non-financial managers, to help you become familiar with the terminology – and what it all means.

Financial management is a crucial aspect of any thriving business. Profit maximization, or stockholder wealth maximization, are two real concerns for any organization – and they depend on solid financial decisions. To make good decisions, management needs good information. And that information comes from the accounting system.

From the accounting system come the financial statements. These statements contain important information about the organization's operating results. This information is important for effective management, and financial control. As a manager, or any other person with financial responsibility, you have to be able to interpret this information yourself.

From the accounting system come the financial statements. These statements contain important information about the organization's operating results. This information is important for effective management, and financial control. As a manager, or any other person with financial responsibility, you have to be able to interpret this information yourself.

Financial statements contain important information about your company's operating results and financial position. The relationship between certain items of financial data can be used to identify areas where your firm excels and, more importantly, where there are opportunities for improvement. Using, understanding, and interpreting these statements will help you make much better business decisions.

The Basic Financial Statements

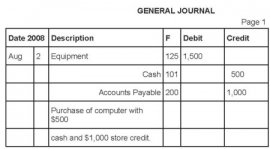

Businesses record their performance in standard formats called financial statements. The most common of these are:

Businesses record their performance in standard formats called financial statements. The most common of these are:

- Balance Sheet (also known as a Statement of Financial Position, or a Statement of Financial Condition).

- Income Statement (Statement of Profit and Loss, Statement of Earnings, Statement of Operations).

- Cash Flow Statement.

While these statements look at different aspects of the company, they are interrelated and dependent on each other, as information from one is needed to prepare the others. The key to understanding accounts is to have a good grasp of what the basic statements are there to do: how they are prepared, what they tell you, and what they don't.

Tip 1:

This article refers to many accounting and finance terms, many of which can be found in our Words Used In… Financial Accounting article.

Tip 2:

If you're not at all familiar with accounts, this article is going to seem quite complicated. However, this is hugely important information once you get beyond a certain level in your career, so it's worth persisting with it!

Read this article three times: firstly, skim it to get an overview of what the income statement, balance sheet, and cash flow statements are. Then give it a thorough re-read so that you understand what's happening in detail. Finally, work through again to cement your understanding. And if you have any questions, just ask in the forums!

YOU MIGHT ALSO LIKE

Share this Post

Related posts

Learn Financial Accounting

Nano learning breaks instruction into self-contained modules that can last from two to 15 minutes. These small lessons focus…

Read MoreBalance sheet in Financial Accounting

What are balance sheets and why are they important

Read More