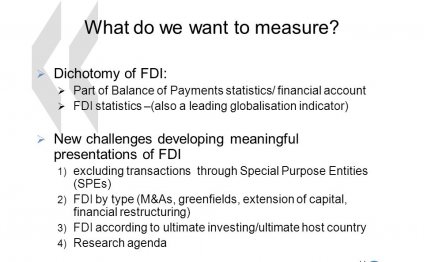

BOP Financial account

The current account, the capital account and the financial account make up a country's balance of payments (BOP). Together, these three accounts tell a story about the state of an economy, its economic outlook and its strategies for achieving its desired goals. A large volume of imports and exports, for example, can indicate an open economy that supports free trade. On the other hand, a country that shows little international activity in its capital or financial account may have an underdeveloped capital market and little foreign currency entering the country in the form of foreign direct investment.

The Capital and Financial Accounts

Along with transactions pertaining to non-financial and non-produced assets, the capital account relates to dealings including debt forgiveness, the transfer of goods and financial assets by migrants leaving or entering a country, the transfer of ownership on fixed assets, the transfer of funds received to the sale or acquisition of fixed assets, gift and inheritance taxes, death levies, patents, copyrights, royalties and uninsured damage to fixed assets.

Detailed in the financial account are government-owned assets (i.e., special drawing rights at the International Monetary Fund (IMF) or foreign reserves), private sector assets held in other countries, local assets held by foreigners (government and private), foreign direct investment, global monetary flows related to investment in business, real estate, bonds and stocks.

Capital that is transferred out of a country for the purpose of investing is recorded as a debit in either of these two accounts. This is because money is leaving the economy. However, because it is an investment, there is an implied return. This return - whether a capital gain from portfolio investment (a debit under the financial account) or a return made from direct investment (a debit under the capital account) - is recorded as a credit in the current account (this is where income investment is recorded in the BOP). The opposite is true when a country receives capital: paying a return on a said investment would be noted as a debit in the current account.

What Does This Mean?

Theoretically, the BOP should be zero. Thus, the current account on one side and the capital and financial account on the other should balance each other out. When an economy, however, has positive capital and financial accounts (a net financial inflow), the country's debits are more than its credits (due to an increase in liabilities to other economies or a reduction of claims in other countries). This is usually in parallel with a current account deficit; an inflow of money means that the return on an investment is a debit on the current account. Thus, the economy is using world savings to meet its local investment and consumption demands. It is a net debtor to the rest of the world.

If the capital and financial accounts are negative (a net financial outflow), the country has more claims than it does liabilities either because of an increase in claims by the economy abroad or a reduction in liabilities from foreign economies. The current account should be recording a surplus at this stage, indicating that the economy is a net creditor, providing funds to the world.

Share this Post

Related posts

Dell Financial account

DELL PREFERRED ACCOUNT (DPA): Offered to U.S. residents by WebBank, who determines qualifications for and terms of credit…

Read MoreF3 Financial Accounting

All questions in the F3 exam are compulsory. The F3 exam contains 35 objective test (OT) questions which are each worth 2…

Read More